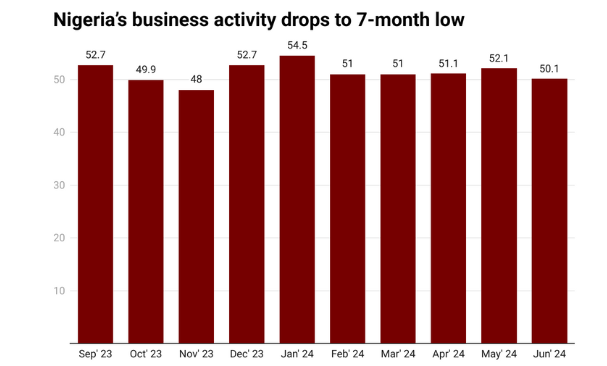

Abuja, July 1, 2025 — Nigeria’s business environment contracted to its weakest level in seven months, a recent Purchasing Managers’ Index (PMI) survey by Stanbic IBTC Bank reveals, as the private sector reels from high inflation and reform pressures.

The headline PMI, pegged at 49.0 in May, slipped below the 50.0 threshold for the fifth straight month—indicating ongoing deterioration—with the headline figure marking the lowest point since November 2024 . Firms cited that persistent inflation and stagnant demand had dampened output and new business flows.

Economists point to recent economic reforms, including foreign exchange liberalization, as exacerbating factors. A report by the organised private sector showed the manufacturing sector’s GDP contribution dropped from 16 percent to 12.7 percent between December 2023 and June 2024—a decline attributed to volatile exchange rates, soaring input costs, and rising interest rates near 27 percent .

The combined impact of price pressures and policy reforms has forced many companies to scale back on input purchases, reduce stock levels, and limit hiring—resulting in a slight but notable dip in employment across the services sector .

However, a silver lining emerges in inflation data: while still high, price growth—particularly in selling prices—has fallen to a seven-month low, and recent PMI readings suggest modest stabilization amid improved fuel prices and currency rates . Some sectors, like agriculture and manufacturing, even experienced marginal upticks in output.

Private-sector heads have urged policymakers to ease macroeconomic headwinds by stabilizing the naira, reducing energy costs, and revisiting fiscal policies — particularly over FX management and interest rates — to bolster industrial recovery and support job retention .

Why it matters: This downturn underlines the fragility of Nigeria’s post‑reform recovery. Persistent inflation and reform-related disruptions are hurting core sectors, risking unemployment and weakening investor confidence. Stabilizing currency and input costs, alongside renewed reform messaging, will be crucial to reversing the current decline.