VIENNA, August 4, 2025 — The Organization of the Petroleum Exporting Countries and its allies (OPEC+) have announced a coordinated decision to raise crude oil output by 547,000 barrels per day (bpd) starting September 2025, citing signs of a stabilising global oil market and improved demand dynamics.

The decision followed a high-level ministerial meeting held virtually and in person at OPEC headquarters in Vienna, where member states assessed recent supply-demand trends, inventory levels, and geopolitical influences impacting global energy prices. Officials said the move is aimed at balancing market stability with gradual economic recovery across consumer nations.

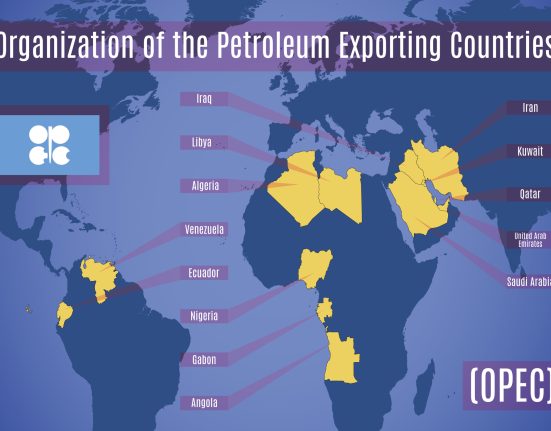

OPEC+ ministers confirmed that the increase will be distributed proportionately among member states, based on existing quotas and production capacity. Major producers like Saudi Arabia, Russia, and the United Arab Emirates are expected to lead the supply boost, while countries with limited spare capacity will maintain current output levels.

Market analysts interpret the decision as a cautious yet confident step by the alliance, following previous output cuts imposed to stabilise prices during periods of oversupply and sluggish post-pandemic demand. Brent crude prices have hovered between $78 and $85 per barrel in recent months, and the production increase is expected to align with steady demand from Asia, Europe, and North America.

OPEC+ also reiterated its readiness to adjust output levels in response to market volatility or unforeseen economic disruptions, maintaining its adaptive strategy to ensure price equilibrium and global energy security.

Energy ministers emphasized that the September increase remains within the framework of the group’s long-term cooperation agreement and is consistent with their commitment to ensuring a reliable and stable oil supply for the global economy.

The announcement has already triggered mixed reactions in financial markets, with investors closely watching how the output hike will influence global inflation trends, especially in developing economies heavily reliant on imported fuel.