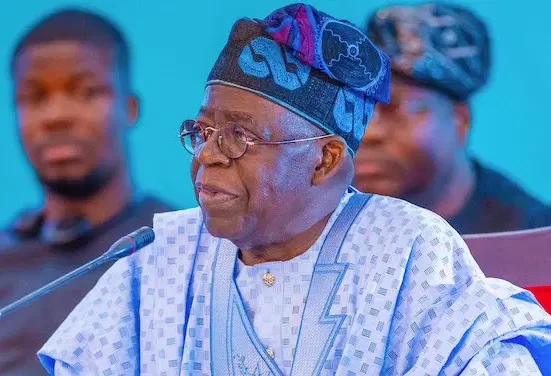

Experts at investment firm Afrinvest have emphasized the urgent need for action to address Nigeria’s debt profile and prevent further deterioration. This was highlighted in their latest macroeconomic update titled ‘Nigeria’s Debt Statistics… High Risk or Not?’ which analyzed the recent visit of IMF’s First Deputy Managing Director, Gita Gopinath. During her visit, Gopinath described Nigeria’s debt level as moderate rather than high risk, offering a somewhat optimistic view of the country’s fiscal position. She stated, “We (IMF) assess debt sustainability for countries every year, and we did this for Nigeria in our report for 2024. Our assessment was that the risk of sovereign stress for Nigeria is moderate and not high risk.” However, Gopinath cautioned that this assessment should not be seen as a license for the country to take on more debt. She emphasized the importance of maintaining a moderate debt level and highlighted the need for increased domestic revenue mobilization. “If you look at the interest payment as a share of revenues, 75 per cent of revenues go into interest payment. That means there is hardly any money for social support or development spending,” she noted. Gopinath also stressed the importance of redirecting savings from fuel subsidy removal into government reserves rather than inefficient spending. She called for optimizing revenue streams through improved tax collection, curbing leakages, and ensuring fiscal discipline. Reacting to the visit, Afrinvest experts aligned with the IMF’s view that a long-term strategy should focus on reducing reliance on debt and strengthening Nigeria’s fiscal position through prudent spending, improved tax collection, and efficient budget allocation. However, they argued that Nigeria’s debt profile demands immediate action to prevent further deterioration. Afrinvest highlighted the Q3:2024 debt statistics published by the Debt Management Office, which showed that total public debt surged to N142.3tn—the highest nominal level on record—driven by a widening budget deficit and the adverse impact of exchange rate depreciation on external debt. Domestic debt rose 3.3 per cent quarter-on-quarter to N73.4tn, while external debt jumped 9.2 per cent q/q to N68.9tn, largely due to the continued depreciation of the naira. The analysts pointed out that the total public debt-to-GDP ratio reached 52.8 per cent, exceeding the 40.0 per cent limit set in the 2020–2023 Medium-Term Debt Management Strategy and nearing the 55 per cent risk threshold for developing countries. Minister of Budget and Economic Planning, Atiku Bagudu, speaking at the KPMG budget 2025 day aired on Arise TV, revealed that sustained positive economic conditions might reduce the high debt servicing allocation in the 2025 budget. He emphasized innovative financing approaches and local bonds as strategies to ensure debt service obligations are met. Meanwhile, Jimi Ogbobine, head of Agusto Consulting, asserted that the current administration of President Bola Tinubu is a big-spending government, raising concerns about the fiscal deficit. Speaking at the rating firm’s 2025 Economic Roundtable, Ogbobine highlighted Nigeria’s debt sustainability as a key concern and stressed the need for attention to this issue. He noted that while Nigeria’s Fiscal Responsibility Act suggests a fiscal deficit of three per cent of GDP, it serves as guidance rather than a strict law.