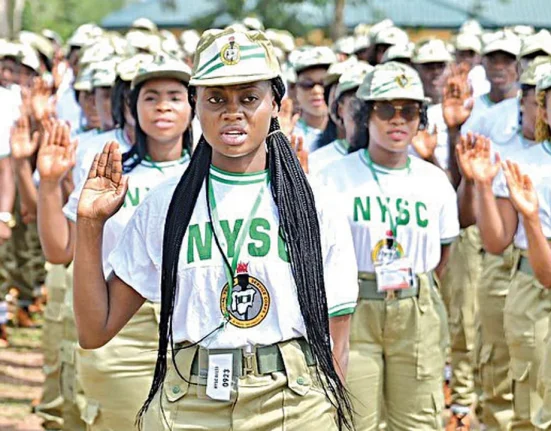

The cycle of financial heartbreak continues as Nigeria grapples with yet another Ponzi scheme collapse, with digital asset platform CBEX joining a notorious list of fraudulent ventures that have drained billions from desperate investors. The latest casualty, CBEX, allegedly vanished with over ₦1.3 trillion after halting withdrawals in April 2025, leaving victims many of whom borrowed heavily to invest stranded and furious. Angry youths stormed CBEX offices in Ibadan and Lagos, vandalizing properties in a futile attempt to recover losses, echoing similar scenes from past scams like MMM and MBA Forex.

The saga began nearly a decade ago with the infamous Mavrodi Mondial Moneybox (MMM), a Russian-originated scheme that promised 30% monthly returns and collapsed in December 2016, wiping out an estimated ₦12–18 billion. Despite warnings from the Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC), millions ignored red flags, lured by early payouts that covered rent, school fees, or medical bills. MMM’s founder, Sergei Mavrodi, died in 2018, but copycats like Ultimate Cycler, Twinkas, and Get Help Worldwide quickly filled the void, leveraging social media and referral networks to attract new victims.

By 2018, crypto-themed scams like Bitclub Advantage and Million Money emerged, capitalizing on Bitcoin’s hype to promise “risk-free” forex trading profits. MBA Forex, operational until 2021, defrauded Nigerians of ₦213 billion by posing as a licensed trading platform, while agricultural crowdfunding scams offered 50% returns on phantom farm investments. The Nigeria Deposit Insurance Corporation (NDIC) estimates that over ₦911 billion was lost to Ponzi schemes between 1999 and 2022, with ₦300 billion vanishing in the five years after MMM’s collapse alone.

CBEX’s April 2025 implosion follows a familiar script: promises of 100% monthly returns via “AI-powered trading,” fabricated account balances, and a 40–45 day withdrawal lock-in period that trapped funds. When users finally attempted to withdraw, balances mysteriously dropped to zero, and customer support pushed a final scam demanding $100–$200 “verification fees” to unlock nonexistent payouts. The scheme’s physical offices, once a trust signal, were revealed as rented shells with no ties to its claimed Chinese headquarters.

Experts attribute this relentless cycle to Nigeria’s economic fragility, where 33% unemployment and 28% inflation drive citizens toward “get-rich-quick” traps. Financial illiteracy exacerbates the crisis, with many unable to distinguish legitimate investments from pyramid structures. While President Tinubu’s 2025 Investment and Securities Act now explicitly bans unregistered platforms, enforcement remains weak, and recovery of lost funds is rare. As SEC Director-General Emomotimi Agama reiterated, “If it’s not registered, it’s illegal,” but for millions of Nigerians, the warning comes too late.