ABUJA – A prominent Nigerian economist has raised concerns over the country’s rising debt burden, cautioning that if left unchecked, it could have far-reaching consequences on national development, fiscal stability, and future generations.

Speaking in an interview with KIIN360, the analyst explained that while borrowing is not inherently bad, especially when used for productive investments, Nigeria’s current debt trajectory shows signs of unsustainable growth. According to the expert, the country is now at a point where its debt servicing obligations are consuming a disproportionate share of revenue, leaving limited fiscal space for capital projects and essential social services.

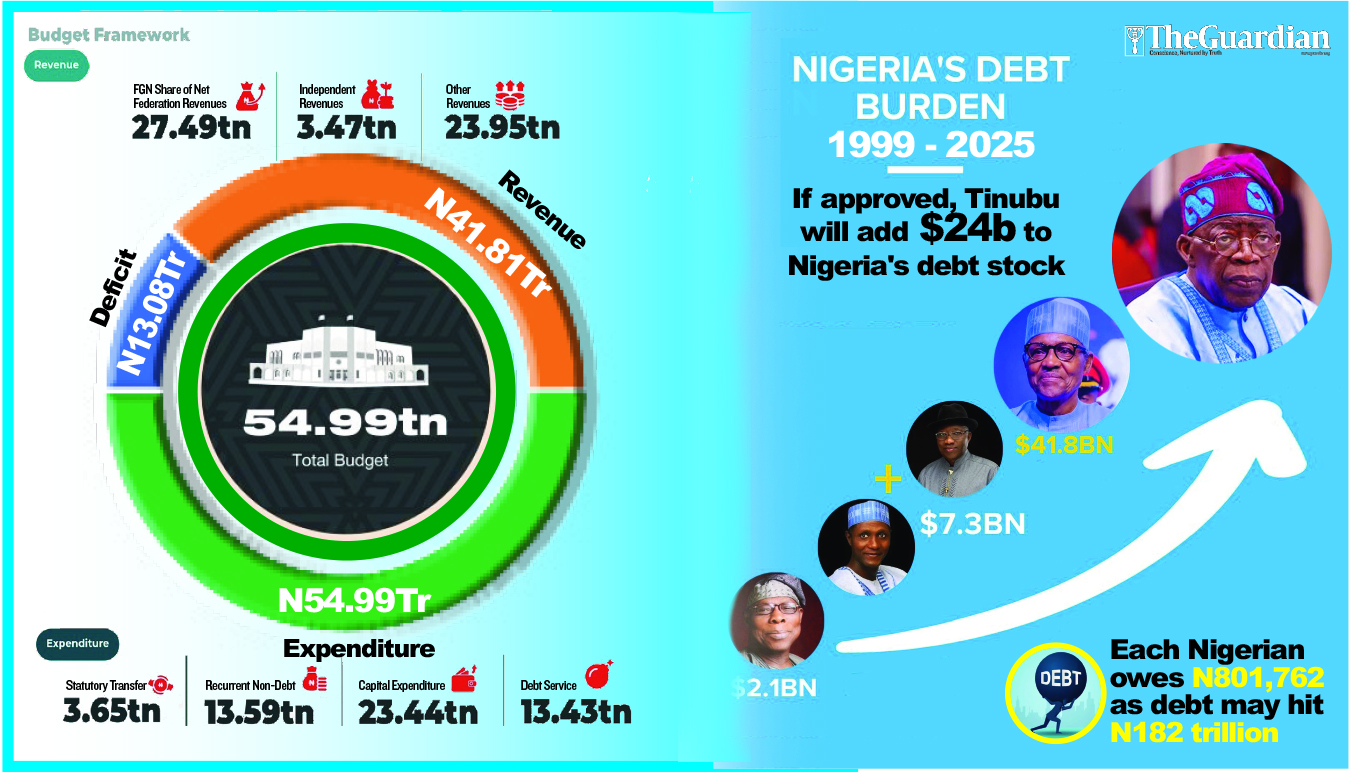

Recent figures from the Debt Management Office (DMO) show that Nigeria’s total public debt hit ₦121.67 trillion as of the first quarter of 2025, with a growing portion owed to both domestic and external creditors. Analysts have continued to express concern that the ballooning debt stock is not being matched by corresponding improvements in infrastructure, productivity, or revenue generation.

“The danger is not in borrowing, but in borrowing without a clear repayment strategy or measurable outcomes,” the economist noted. “What we are seeing is a trend where recurrent expenditure and debt servicing are taking precedence over investments that can stimulate economic growth.”

He added that the continued reliance on loans to fund budget deficits, coupled with dwindling revenue from oil and underperformance in tax collection, could spell long-term economic strain if reforms are not urgently implemented.

The expert called on policymakers to deepen economic diversification, improve public financial management, and cut wasteful spending. He also urged the federal and state governments to ensure that any new debt is tied to revenue-generating or productivity-enhancing projects, rather than for consumption or politically motivated ventures.

As Nigerians grapple with inflation, high unemployment, and a depreciating naira, economists warn that rising debt without tangible results could undermine public trust and further widen the gap between government promises and citizen realities.