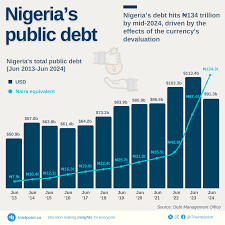

ABUJA — Nigeria’s total public debt has surged to a historic high of ₦144.67 trillion in 2024, representing a sharp increase from ₦97.34 trillion recorded in 2023, according to newly compiled figures tracing the country’s debt trajectory since 2010. However, the dollar equivalent of the debt load fell to $97.75 billion, down from $150.68 billion in the previous year—largely due to currency depreciation and exchange rate volatility.

A review of Nigeria’s public debt over the past 14 years shows a more than 2,600% increase in naira terms from ₦5.24 trillion in 2010 to the current ₦144.67 trillion. The figures include both external and domestic borrowings by the Federal Government, 36 states, and the Federal Capital Territory.

While the naira value of the debt has been on a consistent rise, the dollar equivalent has fluctuated in response to changing exchange rates and macroeconomic conditions. For instance, in 2015, Nigeria’s total debt stood at ₦12.60 trillion ($65.30 billion), but by 2023, the figure jumped to ₦97.34 trillion ($150.68 billion), driven by heavy borrowing, currency devaluation, and economic shocks, including the COVID-19 pandemic.

By 2024, although the naira debt increased by over ₦47 trillion, the dollar equivalent fell by nearly $53 billion, reflecting significant currency devaluation after the Federal Government implemented foreign exchange reforms and unified the naira’s multiple exchange windows.

Economists have raised concerns over the sustainability of Nigeria’s rising debt burden, especially in light of dwindling revenues and mounting debt service costs. The country currently spends a substantial portion of its earnings on debt repayments, leaving limited fiscal space for critical capital projects and social interventions.

Despite the concerns, government officials have maintained that Nigeria’s debt remains within acceptable limits relative to GDP, and that borrowing is essential to bridge infrastructure gaps and stimulate economic growth.

Analysts warn, however, that without meaningful improvements in domestic revenue mobilisation, economic diversification, and prudent fiscal management, Nigeria risks falling into a debt trap, especially as global interest rates remain elevated and concessional financing becomes increasingly scarce.

The public continues to await updated breakdowns from the Debt Management Office (DMO) regarding the composition of the 2024 debt profile, including foreign and domestic debt ratios, loan sources, and repayment obligations.