Economic policymakers are optimistic about driving significant growth as financial sector regulators push forward with bank recapitalisation and foreign exchange (forex) reforms.

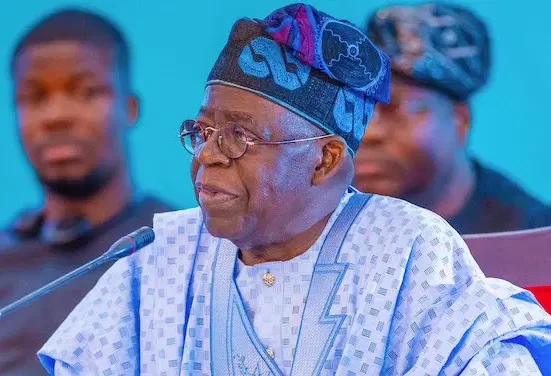

Upon assuming office in 2023, President Bola Tinubu outlined his vision for economic expansion over the next eight years. Analysts have projected that Nigeria’s economy could surpass a $1 trillion valuation within this period, despite standing at approximately $363.8 billion in 2023.

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has underscored the pivotal role of the financial sector in realising this ambitious economic goal. He emphasised the need for stronger banks to facilitate the economic activities necessary to achieve such growth.

This drive is particularly crucial amid the country’s ongoing forex scarcity, exacerbated by the unification of Nigeria’s forex market in June 2023. The unification led to a significant depreciation of the local currency, eroding the asset base of local banks and diminishing their competitiveness against African counterparts.

To address this, the CBN has mandated banks to boost their capital bases within a 24-month period. In a circular issued on March 28, 2024, and signed by the then-acting Director of Corporate Communications, Mrs. Hakama Sidi Ali, the apex bank stipulated that:

Commercial banks with international authorisation must raise their capital base to N500 billion.

National banks are required to increase theirs to N200 billion.

Regional banks and merchant banks must elevate their capital base to N50 billion.

Non-interest banks with national and regional authorisations must enhance their capital to N20 billion and N10 billion, respectively.

Strong Investor Interest in Banking Sector

The recapitalisation process is already in motion, with seven banks collectively raising N1.7 trillion as of November 2024, according to the Securities and Exchange Commission. By the end of the second phase of the recapitalisation, the fresh capital injection is expected to reach N2.99 trillion.

This has sparked renewed investor interest in the banking sector, which recorded 3.66% year-to-date returns as of March 14, 2025—outperforming the equity market, which posted 3% returns over the same period.

Governor Cardoso had previously hinted at the need for bank recapitalisation, stating:

“Will Nigerian banks have sufficient capital to support a $1 trillion economy in the near future? My answer is no—unless we take decisive action. As a first step, we are directing banks to strengthen their capital bases.”

He highlighted that achieving this economic milestone requires sustainable and inclusive growth, with the government already implementing reforms such as petrol subsidy removal and forex market unification.

Mergers and Acquisitions on the Rise

As part of the recapitalisation process, some banks are securing additional capital, while others are exploring mergers and acquisitions (M&As) to strengthen their financial positions. The CBN recently approved the first merger between Providus Bank and Unity Bank. Additionally, Access Holdings Plc, Ecobank Nigeria, and Jaiz Bank have successfully met the new capital requirements.

Experts predict that banks could mobilise around N5 trillion within the two-year recapitalisation window. With about a year remaining before the deadline, industry analysts have observed an increase in M&A discussions as lenders consider alternative capital-raising strategies.

Enhancing Financial Inclusion and Economic Growth

The CBN governor noted that recapitalisation will improve financial inclusion and drive economic growth by enabling banks to:

Take on greater risks, particularly in underserved markets.

Provide more loans to micro, small, and medium enterprises (MSMEs) and rural communities.

Invest in financial technology and innovation, enhancing digital banking services.

He asserted, “Strengthened capital bases allow banks to extend credit, create jobs, and boost productivity. Digital financial services such as mobile banking will further break economic and geographic barriers, ensuring financial inclusion for even the most remote communities.”

The CBN, Securities and Exchange Commission (SEC), and Nigeria Deposit Insurance Corporation (NDIC) form a tripartite committee responsible for verifying banks’ capital compliance before approving funds allocation and incorporation into financial operations.

Reforms Already Yielding Results

The CBN’s recapitalisation efforts, coupled with forex reforms, have begun to show positive impacts.

International Money Transfer Operators (IMTOs) recorded a 79.4% surge in remittances, reaching $4.18 billion in the first three quarters of 2024.

The CBN lifted forex restrictions on 41 previously banned items, enhancing trade and investment opportunities.

These reforms reflect the apex bank’s commitment to fostering an inclusive and resilient economic environment. However, achieving macroeconomic stability will require continuous regulatory vigilance and a proactive monetary policy approach.

Stakeholders Endorse Recapitalisation Drive

Industry leaders have lauded the government’s recapitalisation agenda as a critical step in unlocking Nigeria’s economic potential.

Adedotun Sulaiman, Chairman of the Parthian Group, highlighted the importance of capital in economic advancement, stating:

“Capital is the lifeblood of the economy. Without it, progress is impossible.”

He noted that the firm’s investment funds aim to mobilise resources for key infrastructure projects, supporting the government’s vision for a $1 trillion economy.

SEC Director-General, Emomotimi Agama, echoed similar sentiments, emphasising the need for economic diversification beyond oil exports. He stressed that “investment in infrastructure, human capital, and innovation is essential for long-term growth.”

With ongoing banking sector reforms and a focus on forex stability, Nigeria is positioning itself to meet its ambitious economic targets. However, sustained policy implementation and structural reforms will be necessary to achieve long-term financial stability and prosperity.