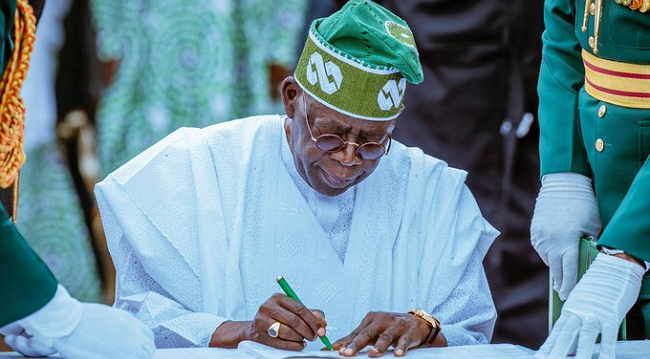

In a significant policy announcement aimed at reshaping Nigeria’s fiscal landscape, President Bola Ahmed Tinubu has formally disclosed a newly signed tax reform law expected to take effect from January 2026. The law, according to the President, is designed to ensure fairness in the country’s tax system by shielding low-income earners from excessive financial burdens while promoting transparency, equity, and economic justice.

Addressing Nigerians through an official message posted on social media, President Tinubu emphasized that the intent behind the new tax regime is not to punish poverty or further marginalize vulnerable groups, but rather to correct systemic imbalances that have long stifled economic inclusivity.

“A fair tax system must never punish poverty or weigh down the most vulnerable,” the President stated, reaffirming his administration’s commitment to equity and true redistribution. “With the new tax laws I recently signed, taking effect from January 2026, we have lifted this burden and created a path of equity, fairness, and true redistribution in our economy,” he added.

As part of this reform, the federal government has introduced a Personal Income Tax Calculator, developed to help citizens estimate their tax obligations under the new policy framework. The digital tool allows users to compare their projected tax payments against their current liabilities, offering a clear illustration of how the new tax model benefits lower-income earners and promotes progressivity.

The initiative is part of the administration’s broader effort to enhance public trust in governance through accessible and accountable systems. The calculator is available at fiscalreforms.ng, a government-endorsed portal established to educate and engage taxpayers on fiscal reforms and compliance procedures.

The reform appears to align with global best practices, focusing on progressive taxation—a system in which higher earners contribute a larger share, thereby reducing inequality and fostering social stability. Fiscal experts have noted that such frameworks tend to support broader economic growth by increasing disposable income among the lower-income brackets, who typically spend a greater portion of their earnings in local economies.

President Tinubu also urged Nigerians to maintain hope and believe in the potential of the country, saying, “Together, we are renewing hope in the Nigeria of our dreams. Take a bet on our country. Bet on Nigeria to work for you, your family, and your community.”

The new law represents a landmark shift in Nigeria’s fiscal policy, setting the stage for a tax system that not only funds development but also protects the economic dignity of all citizens. As January 2026 approaches, all eyes will be on the implementation process and how effectively the government can translate its promises into real, measurable outcomes for everyday Nigerians.