The Organised Private Sector of Nigeria (OPSN) has criticised the Central Bank of Nigeria’s decision to maintain the Monetary Policy Rate (MPR) at 27.5 per cent, warning that the current interest rate environment continues to stifle business growth and investment across sectors.

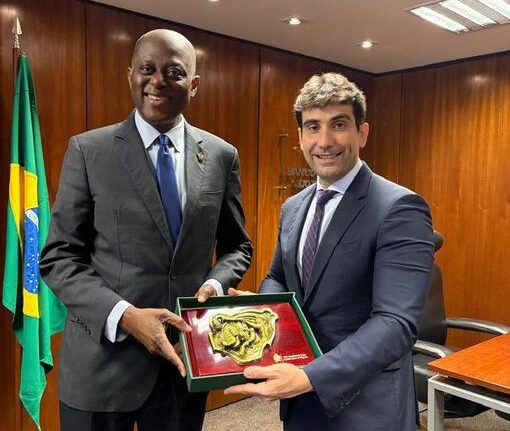

The CBN Governor, Mr. Olayemi Cardoso, announced the policy stance during a press briefing held in Abuja on Tuesday, following the conclusion of the 300th meeting of the Monetary Policy Committee (MPC). This marks the second consecutive time the apex bank has held the MPR steady in 2025, following a series of six rate hikes throughout 2024. Cardoso stated that the decision to maintain the rate was taken unanimously by committee members, who opted to pause further tightening in order to observe short-term developments in the macroeconomic space.

With this decision, the CBN also retained other key monetary parameters: the asymmetric corridor around the MPR remains at +500/-100 basis points; the Cash Reserve Ratio (CRR) for Deposit Money Banks stays at 50.00 per cent; the CRR for Merchant Banks is unchanged at 16.00 per cent; and the Liquidity Ratio is held steady at 30.00 per cent.

Governor Cardoso attributed the MPC’s decision to signs of progress in some macroeconomic indicators. Data from the National Bureau of Statistics showed headline inflation declined to 23.71 per cent in April 2025, from 24.23 per cent in March. Month-on-month inflation saw a sharp drop from 3.9 per cent to 1.86 per cent, while food inflation eased slightly to 21.26 per cent, and core inflation fell to 23.39 per cent in April from 24.43 per cent the previous month. Cardoso noted these changes as encouraging signs, crediting government efforts to improve food supply and security in agrarian regions.

Despite these improvements, the CBN remained cautious, citing ongoing inflationary pressures driven by elevated energy costs, strong forex demand, and structural inefficiencies. The apex bank also acknowledged reforms by the Federal Government aimed at enhancing domestic production and reducing reliance on foreign exchange. Governor Cardoso emphasised the importance of sustained reforms to attract investor confidence and ensure monetary stability.

In a related development, Nigeria’s gross external reserves increased by 2.85 per cent to $38.90 billion as of May 16, 2025, up from $37.82 billion recorded at the end of March. This figure represents approximately 7.6 months of import cover. The MPC commended the narrowing gap between the official and parallel exchange rates and urged fiscal authorities to ramp up foreign exchange earnings, particularly through oil, gas, and non-oil exports.

Also on the agenda was the state of the economy, which recorded a 3.84 per cent growth in real GDP during the fourth quarter of 2024, an uptick from 3.46 per cent in the previous quarter. Growth was attributed to a mix of activity in both oil and non-oil sectors, with particular gains in services. However, the committee raised concerns about the volatility in global crude oil prices—blaming increased supply from non-OPEC countries and uncertainties in U.S. trade policy—as potential threats to Nigeria’s fiscal revenues and budget implementation.

The banking sector was given a vote of confidence, with the MPC lauding the current stability in the system and urging the apex bank to continue its oversight amid ongoing recapitalisation efforts. Cardoso reaffirmed the committee’s commitment to anchoring inflation expectations and easing pressure on the naira through targeted monetary policies. The next MPC meeting has been scheduled for July 21 and 22, 2025.

Meanwhile, reactions have continued to trail the decision, especially from key voices within the business community. OPSN Chairman, Dele Oye, strongly criticised the continued retention of the high interest rate, arguing that the policy stance is counterproductive to private sector-led economic growth. According to him, the 27.5 per cent benchmark makes borrowing nearly impossible for most businesses, which in turn stifles expansion and limits job creation.

Oye, who also serves as President of the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), explained that while high interest rates are often deployed to tame inflation, they simultaneously increase operational costs, reduce access to finance, and dampen investor sentiment. He argued that businesses facing steep borrowing costs tend to either defer investments or abandon projects altogether, which undermines innovation and economic resilience.

He further warned that high rates erode consumers’ purchasing power, reducing demand across retail and service sectors. “The economy cannot thrive with an interest rate at this level. It is neither sustainable for small businesses nor for large enterprises,” Oye added.

Echoing this sentiment, the National President of the Association of Small Business Owners of Nigeria, Dr. Femi Egbesola, welcomed the decision to halt further increases in the MPR but joined calls for a downward review in future. Egbesola described the pause as a sign of sensitivity by the CBN to the challenges facing Micro, Small, and Medium Enterprises (MSMEs), but stressed that any long-term relief must include a significant reduction in the cost of borrowing.

“For Nigeria to truly stimulate economic growth, production, and employment, we need a friendlier interest rate environment,” he said. “A lower MPR would go a long way in supporting small business access to credit, which is essential for national development.”

On his part, the National Vice President of the Nigerian Association of Small Scale Industrialists, Mr. Segun Kuti-George, described the CBN’s decision as pragmatic under the present conditions. He explained that while interest rate hikes serve as a tool to curb inflation, the recent decline in inflation is not yet substantial enough to warrant a policy reversal. However, he remained optimistic that if inflation continues to decline in the coming months, a cut in the MPR may soon follow.

As debate around the interest rate rages on, the private sector continues to press for a more supportive monetary policy to unlock growth potential, even as the apex bank remains focused on stabilising the macroeconomic environment.