In a bid to streamline financial inclusion and ease banking procedures for visitors, the Kingdom of Saudi Arabia has approved the use of a Visitor Identification (Visitor ID) as a valid document for opening bank accounts. This progressive policy is set to benefit millions of expatriates, tourists, and business travelers seeking to access the Kingdom’s financial services without the need for a residence permit.

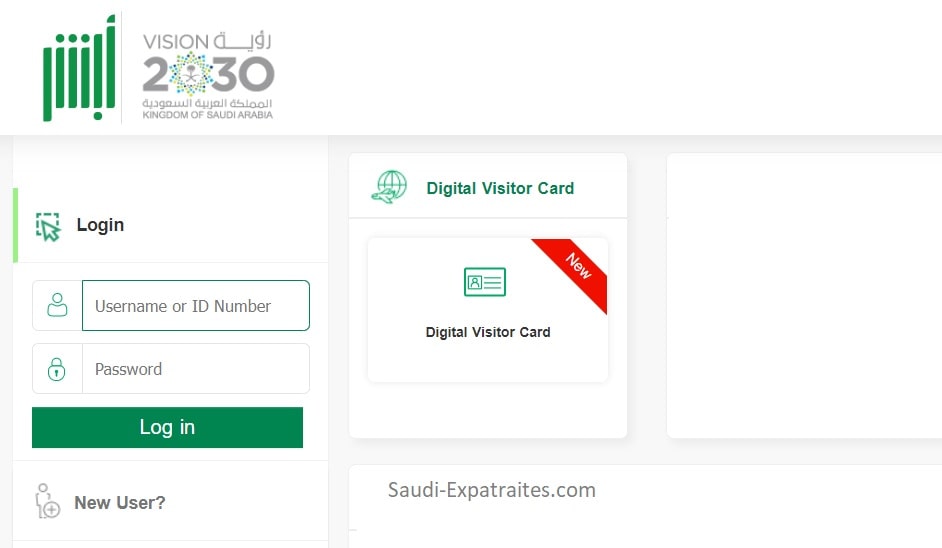

The new regulation, announced by the Saudi Arabian Monetary Authority (SAMA), aims to simplify the onboarding process for non-residents, enabling them to open personal bank accounts with greater ease and flexibility. Previously, foreigners were often required to present a residency permit (Iqama) to access banking services, which limited financial access for short-term visitors.

Under the Visitor ID scheme, banks across Saudi Arabia are authorized to accept this government-issued identification as proof of identity, thereby broadening the scope of individuals eligible for banking products.

The initiative aligns with Saudi Arabia’s Vision 2030 goals to enhance economic diversification, boost tourism, and foster a more inclusive financial ecosystem.

Industry analysts have noted that this move could encourage increased foreign investment and tourism, as easier access to banking services reduces barriers for international visitors and expatriates. It also supports the Kingdom’s efforts to digitize its financial sector and promote cashless transactions.

Banks are expected to implement the new guidelines immediately, with financial institutions enhancing their verification and customer due diligence processes to comply with regulatory standards while facilitating smooth account openings.

As Saudi Arabia continues to position itself as a global business hub and a top destination for international travelers, the introduction of the Visitor ID for banking purposes represents a significant step towards modernizing the country’s financial infrastructure and improving the overall customer experience for foreigners in the Kingdom.