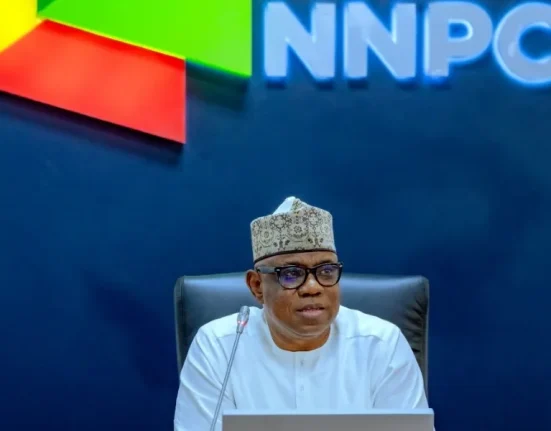

The Nigerian Senate has issued a 10-day ultimatum to the Group Chief Executive Officer of the Nigerian National Petroleum Company Limited (NNPCL), Mele Kyari, demanding a detailed explanation regarding an alleged ₦200 trillion in unaccounted government revenue linked to the state-owned oil corporation.

This directive followed revelations by the Senate Committee on Public Accounts during an ongoing probe into revenue leakages and fiscal inconsistencies involving key government agencies. Lawmakers expressed grave concern over the magnitude of the unremitted funds, insisting that the NNPCL must provide a comprehensive breakdown of its financial operations and reconcile all discrepancies within the stipulated timeframe.

Chairman of the Committee, Senator Aliyu Wadada, disclosed during the session that multiple audit reports had flagged serious concerns about NNPCL’s remittance practices, particularly in relation to revenues generated from crude oil sales, gas exports, and other petroleum-related transactions. He stressed that the legislature has a constitutional obligation to ensure transparency and accountability in the management of national resources.

According to the Senate, the ₦200 trillion in question reflects cumulative shortfalls in remittances spanning several years, despite repeated calls by oversight bodies for clarification. Lawmakers accused the NNPCL of breaching provisions of the Fiscal Responsibility Act and operating without adequate oversight, especially following its transformation from a government agency to a limited liability company under the Petroleum Industry Act (PIA) of 2021.

The Senate insisted that the corporation must submit relevant documents, financial statements, and transaction records to the committee within the 10-day window or risk further legislative action. The lawmakers also hinted at the possibility of inviting other top officials of the NNPCL, including its Chief Financial Officer, should the GCEO fail to honour the summons or provide satisfactory responses.

The development has heightened public scrutiny of the NNPCL’s financial transparency, especially amid Nigeria’s worsening fiscal outlook, growing debt burden, and persistent concerns over dwindling oil revenues despite rising global prices.