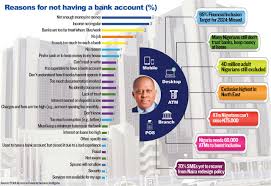

In a renewed effort to bridge the financial divide and bring millions of Nigerians into the formal economy, experts, regulators, and private sector leaders have spotlighted key measures necessary for accelerating financial inclusion across the country.

The consensus was reached at the Payment Forum Nigeria (PAFON 2.0), held in Lagos, where stakeholders dissected challenges and explored scalable solutions to deepen access to financial services, especially in rural and underserved communities.

The drive for enhanced financial inclusion is crucial as Nigeria works toward its ambitious vision of becoming a trillion-dollar economy by 2030. Experts at the summit stressed that meaningful financial inclusion goes beyond opening bank accounts—it requires the delivery of accessible, affordable, and reliable financial services that cater to all segments of the population.

Adebiyi, a telecom industry expert, highlighted the pivotal role of digital identity in financial inclusion. He stated, “Financial inclusion starts with identity. Without a verified identity, millions of Nigerians remain excluded from the financial system. The collaboration between telcos and the government in accelerating National Identity Number (NIN) enrolment is a game-changer.”

Nigeria’s mobile internet penetration continues to offer a fertile ground for digital financial services. As of January 2025, the country recorded approximately 142.16 million active mobile internet subscribers, with an average monthly data usage of 7.04GB per person. This digital surge has fueled the adoption of mobile money platforms, agent banking, and fintech-driven solutions across urban and remote areas alike.

Another key development in the sector is the introduction of AfriGo, a domestic card scheme launched by the Central Bank of Nigeria (CBN) in January 2023. Designed to reduce Nigeria’s reliance on foreign card networks like Visa and Mastercard, AfriGo enables affordable naira-denominated transactions while promoting data sovereignty. Financial experts believe this move will not only cut transaction costs but also expand access to digital payments for low-income earners.

Government efforts to improve financial accessibility are also gaining momentum. In a national broadcast earlier this year, President Bola Ahmed Tinubu announced the establishment of a National Credit Guarantee Company. The institution is expected to provide soft loans to small and medium-sized enterprises (SMEs), women, and young entrepreneurs, facilitating broader access to credit without the traditional collateral burden.

Policy makers at the forum stressed the need for a unified regulatory framework to support innovations in fintech and mobile banking. The call for robust infrastructure, increased investment in financial literacy, and gender-sensitive financial products also resonated throughout the summit.

Nigeria’s financial inclusion strategy has seen modest gains over the years, but experts agree that sustained collaboration between the public and private sectors will be the catalyst for real transformation. As the country continues to push toward a more inclusive economy, the implementation of these measures could significantly narrow the financial access gap and empower millions of Nigerians economically.

The summit ended with a strong commitment from all stakeholders to champion digital transformation as a key pillar of national development, with financial inclusion at its heart.