August 1, 2025

Wema Bank Plc has recorded a remarkable 229% surge in profit for the first half of 2025, driven by significant growth in interest income and strong operational performance across its digital and retail banking segments.

According to the bank’s unaudited financial results released to the Nigerian Exchange Group (NGX), profit before tax (PBT) rose to ₦36.1 billion in H1 2025, compared to ₦11 billion in the same period of 2024. This substantial growth was largely powered by an impressive ₦240.6 billion in interest income, marking a solid leap from ₦142.3 billion reported in the first half of last year.

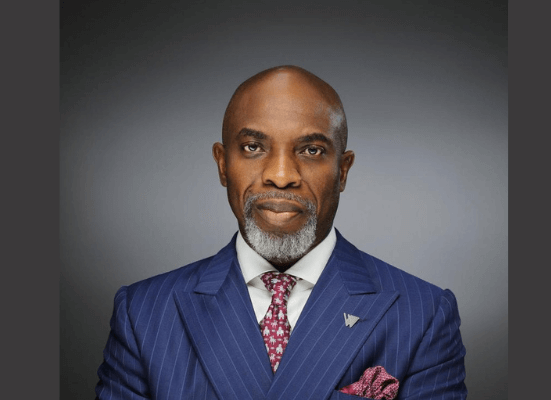

Managing Director and Chief Executive Officer, Moruf Oseni, attributed the outstanding performance to a disciplined growth strategy, digital innovation, and an expanding customer base. He noted that the bank’s focus on efficient capital deployment and improved cost control helped to deliver superior returns for stakeholders.

“Our strategic investments in technology and talent are paying off. We are not just growing — we are doing so sustainably and responsibly,” Oseni said.

Further breakdown of the financials revealed that Wema Bank’s total assets rose by 31% year-on-year, reaching ₦2.3 trillion, while customer deposits climbed to ₦1.6 trillion, reflecting increased market confidence in the bank’s service delivery and digital offerings.

The bank’s digital banking platform, ALAT, continues to play a pivotal role in driving financial inclusion, attracting younger demographics, and simplifying banking through innovation. Analysts believe this growth trajectory positions Wema Bank as a formidable player in Nigeria’s evolving fintech ecosystem.

With this performance, Wema Bank is poised to deliver record full-year earnings, reaffirming its transformation agenda and commitment to expanding its footprint in Nigeria’s financial services industry.