AfrexInsure, the specialty insurance subsidiary of the African Export-Import Bank (Afreximbank), has announced a strategic partnership with Oando Plc to provide tailored specialty insurance solutions for the energy company’s operations in Nigeria.

The partnership aims to protect Afreximbank’s investment in Oando’s operations, including a $650m financing for Oando’s acquisition of Nigerian Agip Oil Company Assets in August 2024. Afreximbank also facilitated Oando’s participation in Project Gazelle, a $3.3bn structured crude oil-backed finance facility sponsored by the Nigerian National Petroleum Company Limited.

According to Jonas Mushosho, CEO of AfrexInsure, the partnership will promote local content in Africa’s oil and gas sector, foster economic empowerment, and contribute to the sustainable development of Africa’s natural resources.

Mushosho noted that many multinationals operating in Africa face high levels of risk, and that affordable trade and specialty insurance solutions can mitigate these risks and encourage firms to engage in enhanced industrialization and export development activities.

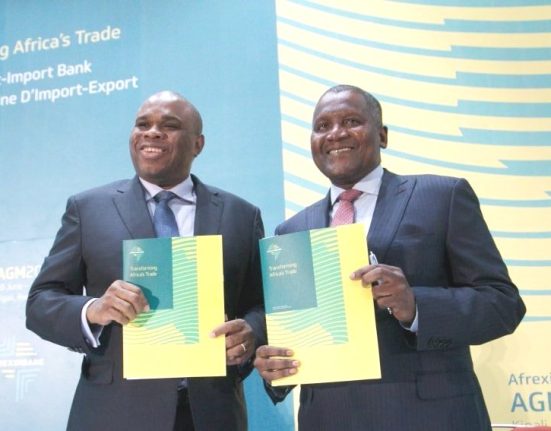

Oando’s Group Chief Executive, Wale Tinubu, expressed confidence that the partnership with AfrexInsure will provide the necessary oversight to ensure the adequacy and comprehensiveness of Oando’s risk management strategy.

However, a recent report by a local media in Trinidad and Tobago raised concerns about Oando’s financial health, stating that the company is in accounting insolvency with total liabilities exceeding total assets.