Dogara Hails Tinubu’s Tax Reforms as Most Ambitious Fiscal Overhaul in Decades

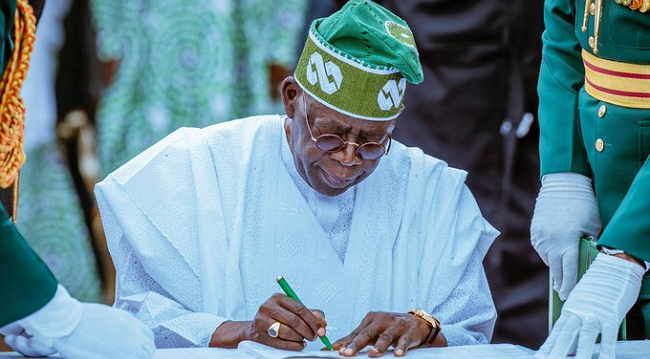

Abuja, Nigeria | September 16, 2025 Former Speaker of the House of Representatives, Yakubu Dogara, has described President Bola Tinubu’s tax reforms as the most ambitious overhaul of Nigeria’s fiscal framework in decades.Speaking on Tuesday during the maiden Distinguished Parliamentarian Lecture at the National Assembly Complex in Abuja, Dogara urged the government to prioritize transparency