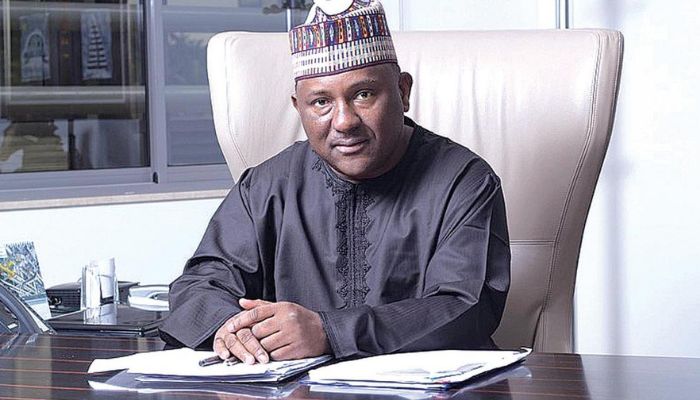

The Chairman of BUA Group, Abdul Samad Rabiu, has assured Nigerians that the era of inflated rice prices is gradually coming to an end, declaring that individuals and companies hoarding rice to artificially drive up prices will soon incur significant losses. Speaking at a media briefing on Thursday following a strategic meeting with President Bola Ahmed Tinubu at the Presidential Villa in Abuja, Rabiu attributed the recent easing in food prices to the federal government’s proactive fiscal policy, particularly the duty waiver on critical food items.

Rabiu lauded President Tinubu’s decision to grant import duty waivers on key staples such as brown rice, wheat, maize, and sorghum, noting that the intervention has played a vital role in moderating food inflation across the country. He recalled that at the peak of last year’s inflationary spiral, the price of a 50kg bag of rice soared to as high as N100,000, while wheat or flour hovered around N80,000 per bag. Maize sold for about N60,000, and a carton of pasta was priced at nearly N20,000.

The billionaire industrialist pointed out that rice hoarders have historically taken advantage of Nigeria’s seasonal farming cycle, buying large quantities of paddy during the harvest season and storing them for months, only to resell at exorbitant prices once scarcity sets in. However, Rabiu said the federal government’s duty waiver had disrupted this profiteering cycle, leaving many hoarders with excess unsold stock.

He noted that farmers typically sell paddy at a steady rate of N400,000 to N500,000 per ton during harvest, but hoarders often resell at inflated prices of up to N800,000 per ton once supply thins out. According to him, “A lot of those hoarders are crying now and losing money. It is important to protect our farmers, but at the same time, we also have 250 million Nigerians who are paying a lot more than they should be, simply because of what a few individuals or companies are doing.”

Rabiu disclosed that BUA Foods has already imported a significant volume of rice that will sustain domestic demand through the end of the year, assuring consumers that prices are unlikely to climb higher. He expressed confidence that the massive supply will flood the market, discourage speculative hoarding, and ultimately stabilize prices at affordable levels.

“I’m optimistic that rice prices will remain stable going forward. When the new harvest season begins, farmers will earn what they typically earn, but hoarders will hesitate to stockpile again because they now know they could lose money,” he said.

He further expressed satisfaction with the downward trend in food prices across the country, citing not only local interventions but also a global supply surplus. Rabiu explained that the current crash in rice prices is partly driven by an international glut, especially from India — the world’s largest rice producer — which has pushed global stockpiles to record highs for the second year in a row and driven prices to their lowest levels in 15 years.

On the rising cost of cement, Rabiu explained that the issue is primarily tied to the naira’s devaluation rather than a pricing anomaly by local manufacturers. According to him, despite the seeming increase in naira terms, the price of cement remains globally competitive when measured in dollars.

“At a current rate of N1,600 to the dollar, even if cement is sold at N9,000 per bag, that amounts to N180,000 per ton or roughly $110 to $120 per ton. That’s comparable to prices in most African markets,” he stated.

He revealed that the weakening of the naira has also tripled operational costs for manufacturers, with his Obu cement plant now paying around N15 billion monthly for gas consumption alone — a significant jump from N5 billion two years ago. Additional cost pressures from imported spare parts, foreign technical experts, and mining operations, all paid in dollars, have further compounded the situation.

Rabiu concluded by reiterating that while currency devaluation was necessary for the Nigerian economy, it had an inevitable impact on manufacturing costs. Nevertheless, he maintained that the price of cement, when adjusted to global standards, is still within a reasonable range.