Nigeria’s foreign exchange (FX) revenue has suffered a significant 73% decline in recent months, driven largely by reduced gains from exchange rate arbitrage. The steep drop reflects the dwindling margin between the official and parallel market exchange rates, a situation that previously offered substantial revenue inflow through arbitrage.

According to data obtained from the Central Bank of Nigeria (CBN) and fiscal policy analysts, this downturn is linked to the reforms introduced by the federal government and monetary authorities to unify exchange rates, curb currency speculation, and stabilize the naira.

Before the reforms, Nigeria earned substantial revenue from the wide disparity between official rates and black market rates, which enabled government agencies and politically connected entities to profit through arbitrage. However, the naira’s managed float and the continued intervention by the CBN have significantly narrowed that gap, thereby shrinking profit opportunities from such activities.

As of July 2025, Nigeria’s average FX revenue from arbitrage has dropped from over ₦450 billion quarterly to less than ₦120 billion. Analysts say this shift, while causing a short-term fiscal strain, is essential to building a more transparent and investor-friendly currency market in the long run.

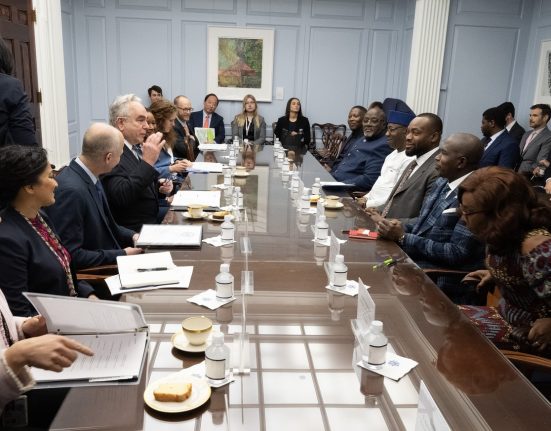

The development also aligns with the fiscal responsibility drive of President Bola Tinubu’s administration, which has repeatedly emphasized the need for long-term structural reforms over temporary windfalls. The decline in arbitrage profits, however, has raised concerns among fiscal planners who are now exploring alternative ways to shore up national revenue, including tax reforms, digital economy expansion, and the revitalization of non-oil exports.

With the naira now trading at a more market-determined rate, experts suggest the government must now focus on boosting productivity, attracting foreign investments, and managing inflation to offset the revenue shortfall caused by the collapse of FX arbitrage.

Nigeria’s Forex Revenue Plunges by 73% Amidst Declining Arbitrage Opportunities

Nigeria’s foreign exchange (FX) revenue has suffered a significant 73% decline in recent months, driven largely by reduced gains from exchange rate arbitrage. The steep drop reflects the dwindling margin between the official and parallel market exchange rates, a situation that previously offered substantial revenue inflow through arbitrage.

According to data obtained from the Central Bank of Nigeria (CBN) and fiscal policy analysts, this downturn is linked to the reforms introduced by the federal government and monetary authorities to unify exchange rates, curb currency speculation, and stabilize the naira.

Before the reforms, Nigeria earned substantial revenue from the wide disparity between official rates and black market rates, which enabled government agencies and politically connected entities to profit through arbitrage. However, the naira’s managed float and the continued intervention by the CBN have significantly narrowed that gap, thereby shrinking profit opportunities from such activities.

As of July 2025, Nigeria’s average FX revenue from arbitrage has dropped from over ₦450 billion quarterly to less than ₦120 billion. Analysts say this shift, while causing a short-term fiscal strain, is essential to building a more transparent and investor-friendly currency market in the long run.

The development also aligns with the fiscal responsibility drive of President Bola Tinubu’s administration, which has repeatedly emphasized the need for long-term structural reforms over temporary windfalls. The decline in arbitrage profits, however, has raised concerns among fiscal planners who are now exploring alternative ways to shore up national revenue, including tax reforms, digital economy expansion, and the revitalization of non-oil exports.

With the naira now trading at a more market-determined rate, experts suggest the government must now focus on boosting productivity, attracting foreign investments, and managing inflation to offset the revenue shortfall caused by the collapse of FX arbitrage.