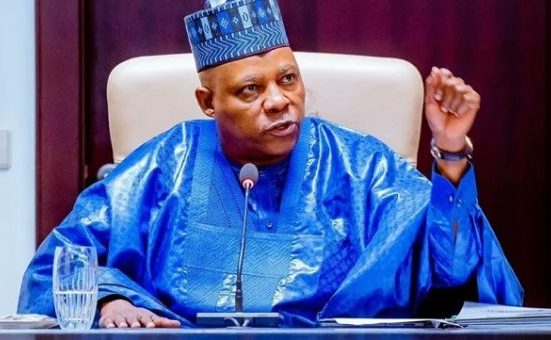

Vice President Kashim Shettima has attributed Nigeria’s alarmingly low tax-to-GDP ratio to decades of widespread tax evasion and wealth concealment. Speaking at the 2nd Joint Workshop on 2025 National Budget, organized by the Association of National Accountants of Nigeria and the Chartered Institute of Taxation of Nigeria, Shettima lamented that many Nigerians have mastered the art of hiding their wealth from the government.

Key Factors Contributing to Low Tax-to-GDP Ratio

Tax Evasion: Widespread tax evasion has significantly reduced government revenue, hindering the nation’s development.

Wealth Concealment: Many individuals and businesses have perfected the art of concealing their wealth, depriving the government of essential funds.

Lack of Investment in National Development:

Nigerians often invest abroad, missing out on higher returns and psychological benefits of investing in their own country.

Government Initiatives to Address the Issue

The 2025 budget, valued at N54.99 trillion, aims to:

Reduce Leakages and Wastages: Ensure value for money and prioritize investments in critical infrastructure and human capital development.

Decrease Debt Burden: Finance a deficit of N13 trillion through public-private partnerships, local and foreign borrowing.

Call to Action

Shettima urged stakeholders to educate the public on the importance of investing in Nigeria, highlighting the benefits of investing in their own country. He emphasized that nobody will develop Nigeria except Nigerians themselves, stressing the need for collective action to address these challenges.

Nigeria’s low tax-to-GDP ratio is a pressing concern that requires immediate attention. The government, along with stakeholders, must work together to address tax evasion, promote investment in national development, and ensure effective utilization of resources to drive economic growth and prosperity.

General

Nigeria’s Low Tax-to-GDP Ratio: A Persistent Challenge

- by Abideen Adenekan

- April 5, 2025

- 0 Comments

- 1 minute read

- 150 Views

- 6 months ago

Leave feedback about this