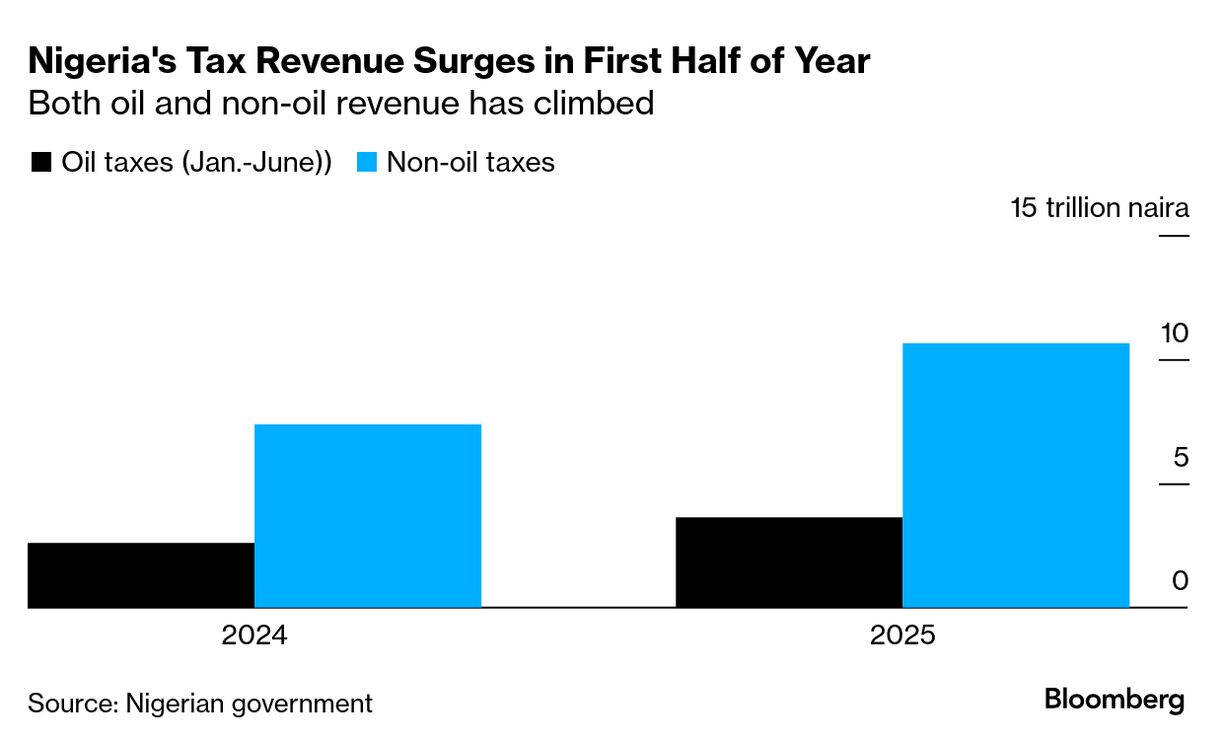

Abuja, Nigeria – Nigeria’s Federal Inland Revenue Service (FIRS) delivered a massive ₦3.3 trillion ($2.18 billion) in tax revenue for June 2025, blowing past its monthly target by a remarkable ₦1.36 trillion. The surge, detailed in figures prepared for the Federation Account Allocation Committee (FAAC) ahead of its July 16 meeting, signals a significant shift in the nation’s fiscal landscape.

The standout performer was Company Income Tax (Non-Oil), which contributed ₦1.65 trillion, nearly tripling its ₦592 billion budget. This segment alone accounted for over 50% of the total revenue surplus, underscoring robust growth in non-oil corporate earnings and potentially more effective compliance measures by the FIRS.

Other key areas also saw substantial gains:

Tax on Gas revenue hit ₦223.1 billion, exceeding its ₦56.7 billion budget by ₦166.5 billion.

Capital Gains Tax (CGT), typically a laggard, defied expectations with ₦292.9 billion, a staggering 59 times its ₦5 billion target.

Value Added Tax (VAT), combining non-import and import sources, collectively brought in ₦678.3 billion, slightly above projections.

However, the crucial Petroleum Profits Tax (PPT)/Hydrocarbon Tax from the oil sector underperformed, bringing in ₦356 billion against a budgeted ₦436.8 billion, missing by ₦80.8 billion. Similarly, Stamp Duties and Electronic Money Transfer Levies fell short of targets.

This strong performance comes at a critical juncture for Nigeria, which is battling fiscal pressures, volatile foreign exchange rates, and the ongoing impact of subsidy reforms. Adding to the potential fiscal cushion, the report also projects ₦2.2 trillion in expected receipts from the Nigerian National Petroleum Company Limited (NNPCL) under joint venture and production sharing contract arrangements from June 2023 to December 2024.

Bottom Line: The FIRS’s June figures highlight a pivotal moment in Nigeria’s revenue diversification efforts. Non-oil and capital gains taxes are increasingly compensating for underperformance in the petroleum sector. Sustaining this momentum, however, will hinge on the implementation of structural reforms and consistent policy enforcement.

Business

Nigeria’s Tax Haul Soars on Non-Oil Strength, Dwarfing Budget by ₦1.36 Trillion

- by Balogun Monsurudeen.F.

- July 29, 2025

- 0 Comments

- 1 minute read

- 161 Views

- 2 months ago