July 2, 2025 — Global oil prices climbed on Tuesday, buoyed by signs of robust fuel demand amid the summer driving season, even as investors turned their attention to an anticipated decision from OPEC+ that could shape the market’s direction in the coming months.

Brent crude futures settled higher at $86.42 a barrel, gaining $1.07, while U.S. West Texas Intermediate (WTI) crude rose by 98 cents to close at $82.94 per barrel. The price movement reflected optimism in the market following a series of indicators pointing to sustained demand, particularly in the United States and Asia.

Traders cited higher refinery activity and a drawdown in U.S. gasoline inventories as signs that consumption remains strong, reinforcing expectations that global fuel usage could remain elevated through the third quarter of the year.

“Demand is looking solid across major economies, and that’s giving crude some upward momentum,” a commodities analyst told Reuters. “What’s keeping the market on edge now is what OPEC+ will decide regarding production levels.”

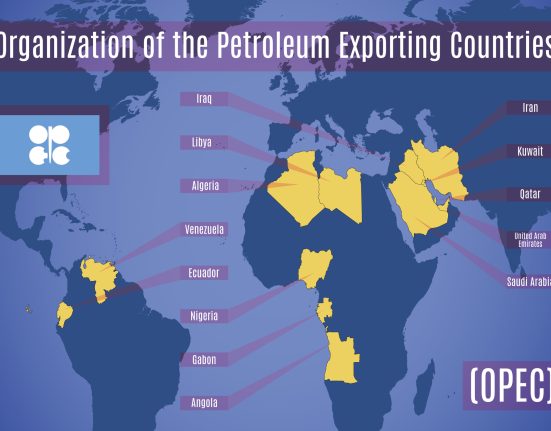

The Organization of the Petroleum Exporting Countries and its allies, known as OPEC+, are scheduled to meet later this week. Markets are closely watching to see whether the group will stick to its current production curbs or adjust output in response to evolving demand and price trends.

Investors are also factoring in broader economic signals, including cooling inflation in the U.S. and expectations that interest rates could begin to ease later in the year—factors that could further stimulate industrial activity and energy consumption.

While price volatility remains a risk, analysts say near-term outlook for oil remains tilted toward the upside, provided geopolitical tensions stay contained and economic data continues to show resilience.

As the market awaits clear direction from OPEC+, traders will be monitoring inventory reports, refinery margins, and geopolitical developments for further clues about oil’s trajectory in the second half of 2025.