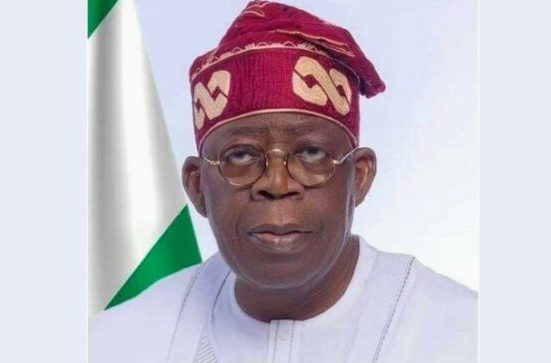

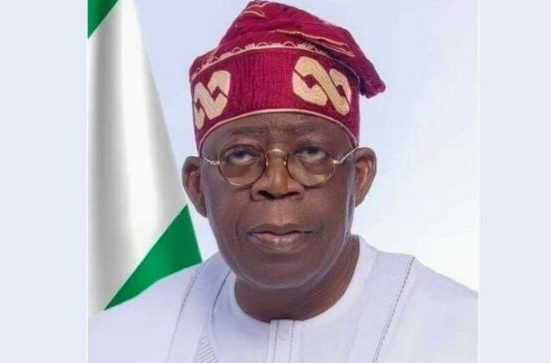

ABUJA ,August 6, 2025 — In a landmark move aimed at energizing Nigeria’s financial services sector, President Bola Ahmed Tinubu has signed into law the Nigerian Insurance Industry Reform Act 2025, a transformative legislation designed to modernize insurance operations and support the country’s $1 trillion economy ambition.

The new law, signed at the Presidential Villa on Tuesday, seeks to overhaul outdated regulatory frameworks, improve investor confidence, and boost public participation in insurance services across the country. It introduces sweeping reforms that include stricter solvency requirements for operators, digitization mandates, enhanced consumer protection policies, and streamlined claims processing procedures.

President Tinubu described the Act as “a major step toward deepening financial inclusion and economic resilience,” stressing that a revitalized insurance sector would serve as a pillar for national development, investment security, and wealth preservation. He reaffirmed his administration’s commitment to comprehensive economic reforms that promote private sector growth and job creation.

Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, said the law will foster a more competitive, transparent, and innovative insurance market. He added that Nigeria’s insurance penetration remains below 1% of GDP and that the reform is expected to unlock significant value for the nation’s economy.

The National Insurance Commission (NAICOM) also welcomed the legislation, stating it will provide the regulatory authority with expanded powers to enforce compliance and reposition the sector for international competitiveness.

The signing of the Insurance Industry Reform Act 2025 aligns with Nigeria’s long-term Economic Recovery Plan and is projected to stimulate growth in key sectors such as infrastructure, agriculture, SMEs, and oil and gas by mitigating investment risks and enhancing access to insurance solutions.