The United States government has once again expressed concerns over Nigeria’s trade practices, highlighting significant barriers to the importation of American agricultural products and pointing to systemic inefficiencies in Nigeria’s port operations. In its 2025 National Trade Estimate Report on Foreign Trade Barriers, the Office of the United States Trade Representative (USTR) reiterated that Nigeria’s delays in approving import permits for US food and agricultural products have remained a persistent issue, preventing American goods from entering the Nigerian market.

Since 2019, the US has been pressing for the approval of import permits for several categories of agricultural goods, but the Nigerian authorities have failed to take action on numerous pending requests, the report states. This delay is part of a broader issue of trade barriers that the USTR says have hindered the flow of goods between the two countries. The report also pointed to Nigeria’s inability to properly inspect and clear goods in a timely manner, which has led many traders to resort to informal channels to move their goods into the country.

The USTR further criticized Nigeria for its inconsistent application of sanitary and phytosanitary rules, which are meant to ensure food safety and agricultural health. These inconsistencies, the report said, have caused confusion and difficulty for exporters who struggle to navigate the complex regulatory environment. In particular, the report highlighted that Nigeria’s weak infrastructure and lack of modernized systems for processing imports were contributing factors to the slow clearance of goods.

Despite ongoing efforts by the Nigerian government to modernize its customs and trade systems, such as the $3.1 billion customs modernization project approved in 2020, the report notes that progress has been slow. Legal disputes have delayed the implementation of the project, and corruption within the customs service continues to undermine efforts to streamline trade processes.

In addition to these logistical challenges, the US government pointed out the high tariffs and supplementary import charges imposed by Nigeria, which significantly increase the cost of doing business in the country. While Nigeria’s average Most-Favored-Nation tariff rate stood at 12 percent in 2023, agricultural products were subject to a 15.9 percent tariff, while non-agricultural goods attracted an 11.4 percent tariff. The report also revealed that Nigeria levies additional charges that can raise the effective tariff rate to 50 percent or more on a variety of products, including 79 tariff lines that attract a combined duty and other import fees of 70 percent or more.

The continued import bans on 25 product categories, such as poultry, beef, certain alcoholic beverages, and used vehicles older than 12 years, were also flagged as major trade restrictions by the USTR. These bans, the report states, create significant barriers to trade, further straining commercial relations between the US and Nigeria.

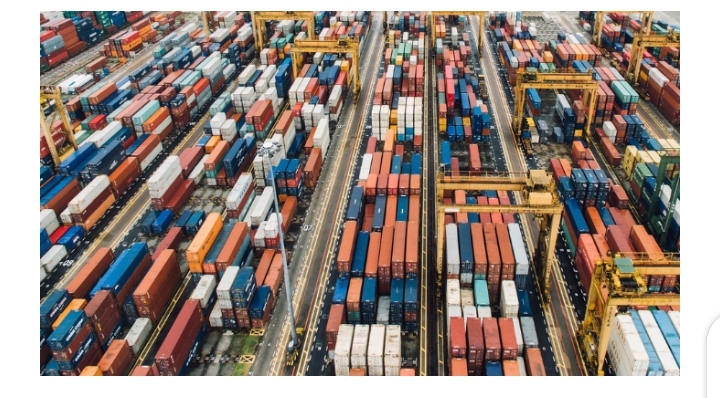

Another point of contention was Nigeria’s customs administration, which the report described as plagued by corruption and outdated manual processing systems. Despite efforts to modernize, the USTR argued that Nigeria’s ports, especially the Apapa port in Lagos, remain some of the most expensive in the world. The report highlighted the 30-day average delay to clear a container ship at Apapa, contributing to the high costs of doing business and complicating trade with the United States.

On the issue of public procurement, the US government raised concerns about the lack of transparency and compliance with procurement guidelines. US companies often struggle to access government contracts due to issues such as delayed payments and the failure of Nigerian agencies to adhere to established procurement procedures. Additionally, the report noted that foreign government-subsidized financing sometimes played a role in securing government contracts, which further complicated the process for US firms.

The report also took note of Nigeria’s ongoing issues with intellectual property enforcement, particularly in relation to counterfeit goods. Despite the passage of the Copyright Act in 2022 and other reforms, the availability of counterfeit pharmaceuticals, automotive parts, and consumer goods remains widespread, posing serious risks to public health and safety.

In the digital space, the US raised concerns over Nigeria’s data localization rules, which require that data on Nigerian citizens be stored within the country. While these rules have not been rigorously enforced, they still create uncertainty for businesses. Furthermore, new taxes on digital services provided by foreign companies to Nigerian consumers, introduced by the Finance Acts of 2020 and 2021, have also raised concerns among US companies operating in Nigeria.

Foreign exchange policies were another area of concern. While the Central Bank of Nigeria (CBN) unified exchange rates in 2023 and lifted restrictions on foreign exchange for 43 previously barred items, challenges remain. US companies have reported significant delays in obtaining approval to repatriate funds, with a backlog of about $7 billion in foreign exchange, of which only $4.6 billion had been cleared by March 2024.

In response to the criticisms from the US, the Nigeria Customs Service (NCS) issued a rebuttal, rejecting claims that it still operates largely manual systems. Abdullahi Maiwada, the NCS spokesperson, described the US government’s report as “unfair” and “misinformed.” He emphasized that the Nigeria Customs Service has made significant strides in automating its systems to improve trade facilitation. He further stated that the NCS is responsible for implementing fiscal policies, but not for formulating them. Maiwada assured that the NCS remains committed to responding to policy challenges and improving trade processes in the country.

This ongoing tension between the US and Nigeria over trade practices is likely to remain a point of focus in bilateral relations, with both countries seeking to address the barriers to smoother trade and investment flows.